Real Estate Investment Modelling In Excel Vs Modern Platforms

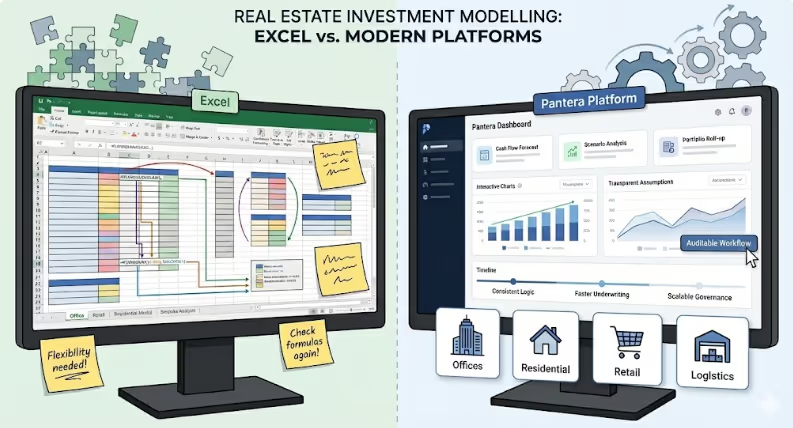

Real estate investment modelling in Excel versus modern platforms is a choice between maximum flexibility and repeatable, transparent decision-making.

Excel excels at bespoke analysis, while modern platforms structure modelling consistently across asset classes, reducing risk and improving speed at scale.

Is this a general modelling concept across asset classes?

Yes. While modelling details vary by asset class, the core modelling problem is the same across offices, residential, retail, logistics, and alternatives:

- Forecast cash flows

- Apply costs and capital expenditure

- Assess risk and return

- Derive value under different scenarios

The tools used to do this influence speed, clarity, and confidence, regardless of asset type.

Why does this comparison matter across asset classes?

As portfolios diversify, modelling approaches need to work consistently across multiple asset types. Excel models often evolve asset-by-asset, while modern platforms aim to standardise core logic and vary assumptions.

This comparison matters because it affects:

- Consistency of underwriting across asset classes

- Portfolio-level decision-making

- Governance, auditability, and review

- Scalability as teams and asset counts grow

How Excel-based real estate modelling typically works

Typical Excel workflow

In Excel, models are usually:

- Built separately for each asset or asset class

- Adapted from prior templates

- Extended over time with additional logic

- Maintained by individuals or small teams

Differences between offices, residential, retail, or logistics are handled through bespoke tabs and formulas.

Strengths of Excel across asset classes

Excel remains widely used because it:

- Handles unusual or non-standard assets well

- Allows full formula-level control

- Can be quickly adapted for niche strategies

For one-off analysis, Excel often remains the fastest way to explore an idea.

Limitations of Excel at scale

Across multiple asset classes, Excel models commonly suffer from:

- Inconsistent assumptions and structures

- Limited comparability between assets

- High risk of hidden errors

- Difficulty rolling models up to portfolio level

These issues compound as portfolios grow.

How modern platforms approach multi-asset modelling

Typical platform-based workflow

Modern real estate platforms are designed around common building blocks:

- Income units (leases, tenancies, or operating income)

- Operating costs and recoverability

- Capital expenditure and lifecycle costs

- Debt and equity structures

- Valuation logic

Asset classes differ in inputs, but the modelling framework remains consistent.

Strengths of modern platforms across asset classes

Modern platforms typically provide:

- Consistent modelling logic across asset types

- Faster underwriting for repeat transactions

- Built-in scenario and sensitivity analysis

- Portfolio-level aggregation and reporting

This makes them well suited to diversified investment strategies.

Limitations of modern platforms

Modern platforms may be less suitable when:

- An asset has highly bespoke or experimental cash flows

- The investment structure is unusual

- Teams require unrestricted formula access

They prioritise standardisation over absolute flexibility.

Excel vs modern platforms: asset-agnostic comparison

AreaExcel-based modellingModern platformsFlexibilityVery highMedium to highConsistency across assetsLowHighSpeed for repeat analysisLowHighPortfolio roll-upManualNativeAuditabilityDifficultClearGovernanceInformalStructured

When Excel is the better choice

Excel is often the right tool when:

- Analysing a one-off or highly bespoke asset

- Prototyping a new strategy or asset class

- Maximum modelling freedom is required

Many teams continue to rely on Excel for early-stage analysis.

When modern platforms are the better choice

Modern platforms are typically better suited to:

- Multi-asset portfolios

- Funds investing across sectors

- Ongoing asset management and reforecasting

- Investment committee processes requiring transparency

Repeatability and comparability often outweigh full flexibility.

How Pantera fits into a multi-asset context

Pantera is a UK-based real estate investment, development, and portfolio modelling platform designed to support modelling across asset classes. It applies consistent modelling principles while allowing asset-specific assumptions for:

- Offices, residential, retail, and logistics

- Development and stabilised assets

- Single assets and portfolios

The fundamentals of modelling do not change, but the workflow becomes more consistent and auditable.

Common mistakes when thinking cross-asset

Common pitfalls include:

- Assuming one Excel model can cover all asset classes cleanly

- Over-standardising assets that genuinely behave differently

- Confusing tooling consistency with investment judgement

Tools support decisions; they do not replace asset-level expertise.

Final takeaway

Excel and modern platforms address the same real estate modelling challenge at different scales. Excel is powerful for bespoke analysis, while modern platforms are designed for consistency, transparency, and portfolio-level decision-making across asset classes.

The right choice depends less on asset type and more on volume, governance, and decision complexity.

Future-proof your

property business

%20(2).png)

%20(1).png)